Digital Asset Arbitrage Strategy in a Private Equity Structure

The AIM Crypto Strategy offers a private share placement opportunity exclusively to qualifying participants.

Through the acquisition of shares in a dedicated Special Purpose Vehicle (SPV), participants gain equity exposure to a company that applies its capital to digital asset arbitrage activities, executed by an authorised financial services provider (FSP) operating under South African regulatory frameworks.

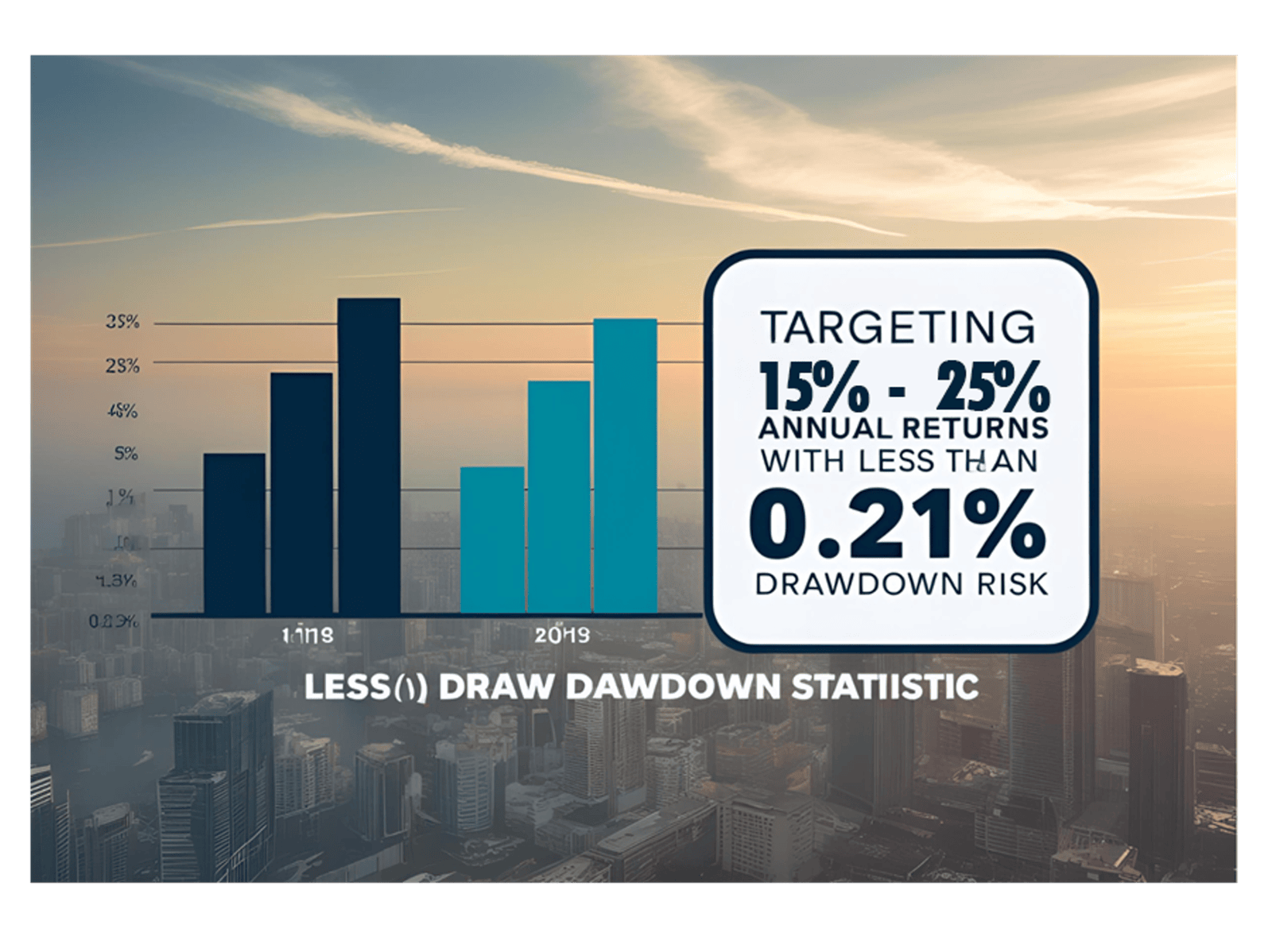

The strategy has been commercially deployed and operates within an environment of regulatory oversight, with prior execution experience by the appointed FSP.

Grounded in hands-on experience across arbitrage strategy design, fintech infrastructure, and currency movement frameworks.

Strategy Arbitrage Desk