USP

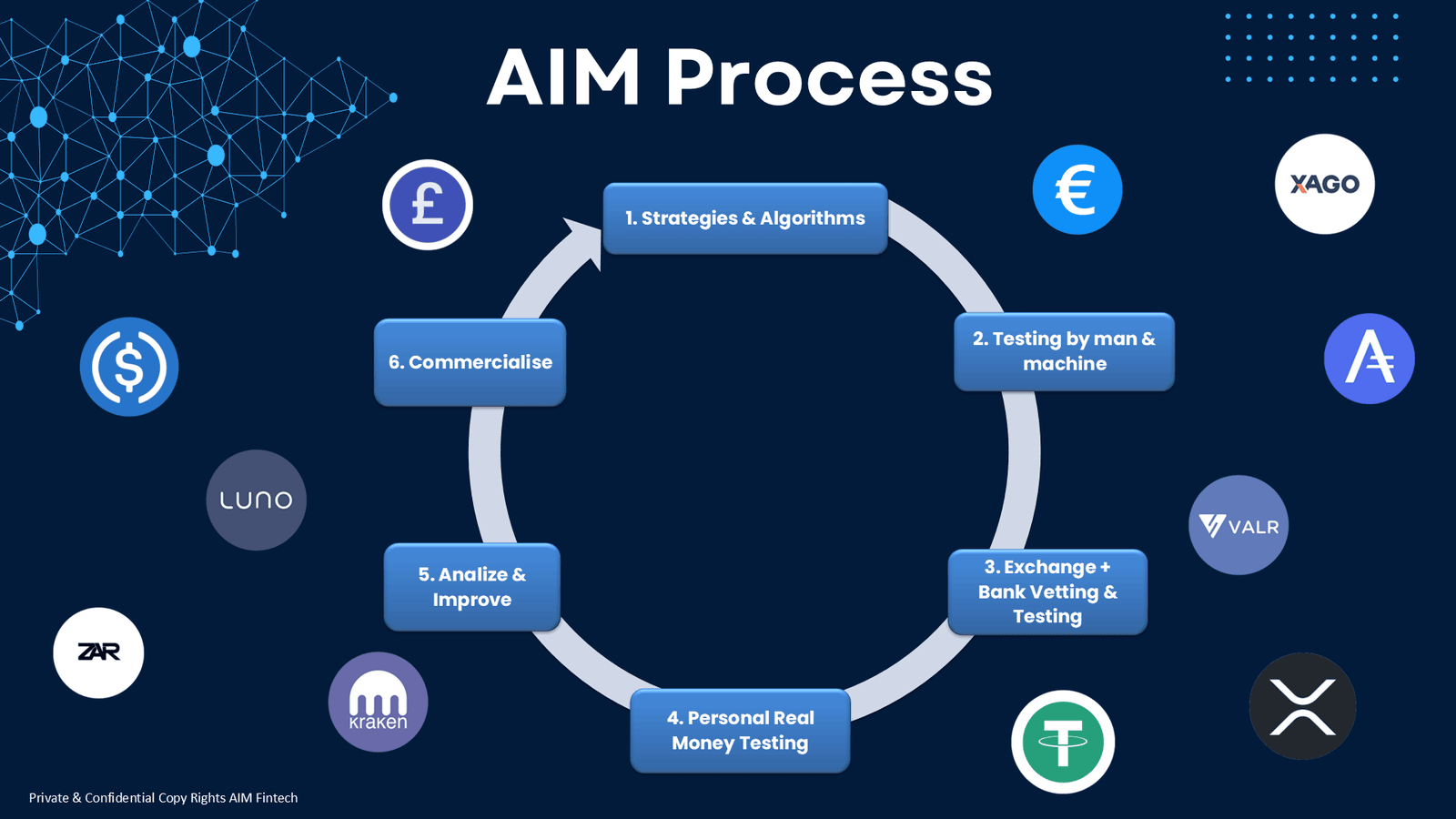

Cross-Currency & Cross Exchange Trading

Arbitrage across multiple exchanges with both currencies and digital assets.

Currency Rebalancing

The company applies its capital in a rules-based and responsive manner, enabling participation in identified pricing differences without automated fund pooling or rebalancing mechanisms.

Continuous Mining

Continuous mining of inefficiencies - no downtime.

47 programmed strategies are now generating profit.

Money Transfer

Instant, low-cost cross-border settlements without traditional banking delays; and

Cost-efficient, compliant, and borderless fund transfers.

Partner With Us To Build a Resilient Business

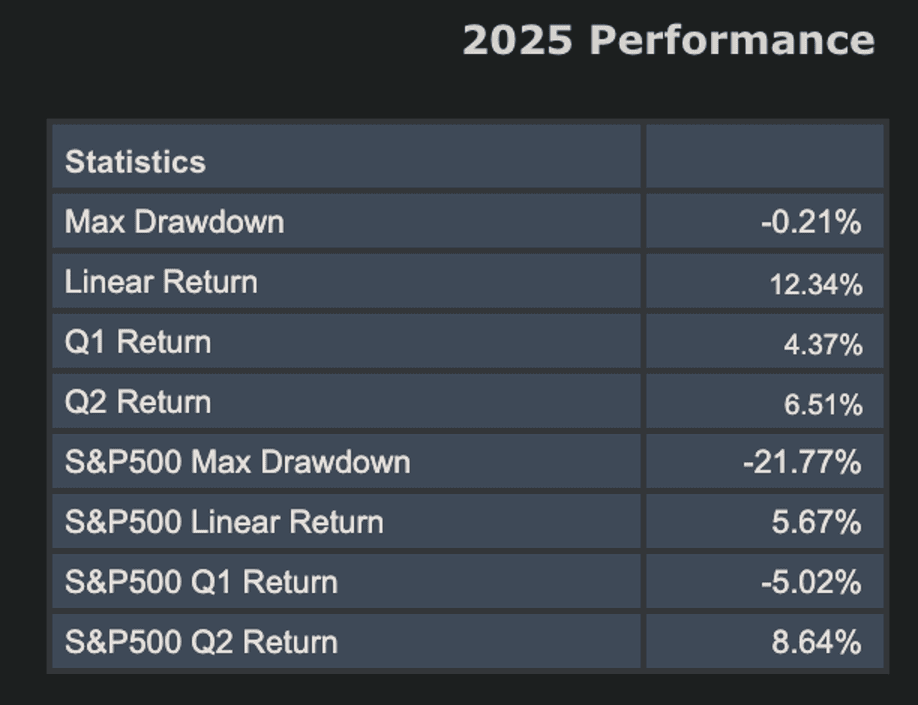

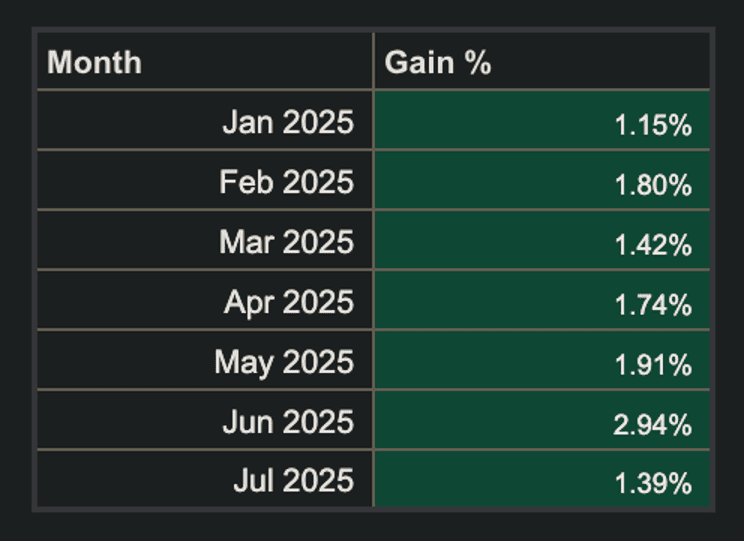

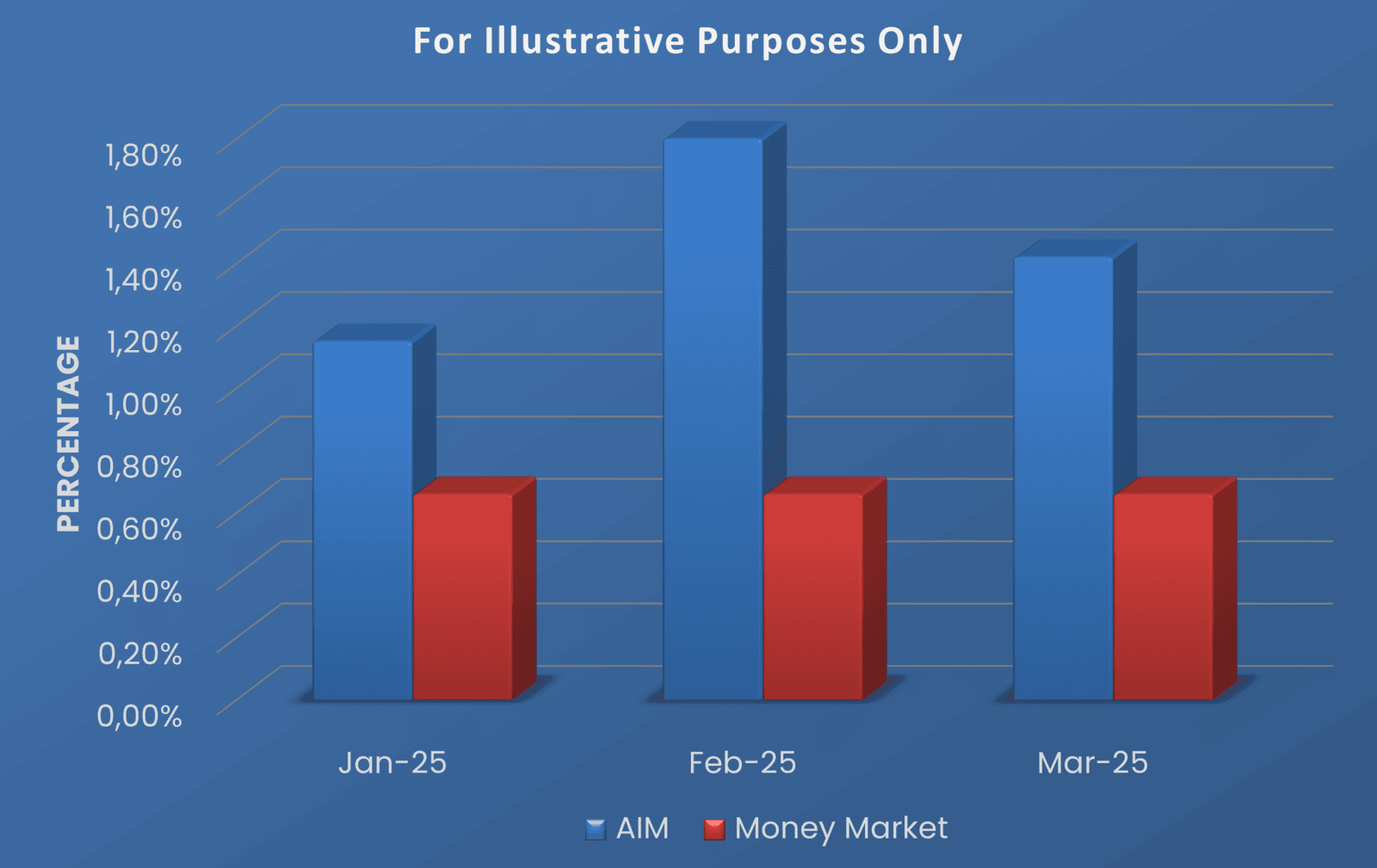

• 1.5% average monthly return (linear) • 90% USD holding during inactivity supports crypto price risk management

• Maximum drawdown 0.21% •10% Crypto functional holding • Beta Returns ignored

Prioritising Risk Discipline in a Commercial Context

Structural Exposure: Activity is inherently linked to bank and exchange-related infrastructure, with all associated commercial and operational risks

Trade Discipline: Trades only execute when profitable conditions are present — however, no outcome is guaranteed

Current Asset Allocation: 90% USD and 10% XRP in non-operational holding

The strategy is exposed to market and infrastructure dynamics:

Drawdowns Reflect Market Conditions, Not Predictable Patterns

On 3 March 2025, the largest drawdown recorded was 0.21% due to a latency issue on a third-party exchange

A subsequent 0.21% drawdown occurred on 4 March 2025

These rare incidents led to cumulative losses of 0.137% of total turnover

These occurrences, while limited, underscore the inherent commercial risk associated with the activity.